Use cases

Other MyProof use cases for M&A teams

M&A teams manage highly confidential information for mergers and acquisitions. Our a tool for M&A teams provides a reliable environment for storage, sharing and time-stamping of sensitive documents, facilitating transactions while guaranteeing data confidentiality and integrity.

Secure storage of target companies' confidential information

During mergers and acquisitions, the protection of confidential information is essential. MyProof offers a solution for storing target company documents securely during due diligence.

Our platform enables M&A teams to manage sensitive data throughout the process. It offers :

- Encrypted hosting of strategic files

- Controlling access to information

- Collaboration tools for authorized stakeholders

In this way M&A professionals can share and analyze target company data securely during negotiations.

Secure drive for M&A data protection

M&A transactions require rigorous management of confidential information. Our platform provides a secure environment for storing and sharing documents related to these transactions. Visit M&A teams benefit from a dedicated space to carry out their due diligence.

This secure drive for M&A data protection offers several advantages:

- Control access to sensitive files

- Traceability of user actions

- Compliance with confidentiality standards

Our solution enables M&A professionals to collaborate efficiently while preserving the integrity of strategic data during the transaction process.

Alternative to the soleau envelope for memorandums of understanding

Visit M&A teams are looking for effective ways to establish the precedence of memorandums of understanding. MyProof meets this need with modern technology.

Our system uses the blockchain to generate proof of the existence of documents at specific points in time. This method is presented as a alternative to the Soleau envelope for preliminary agreements.

M&A specialists now have a digital tool to time-stamp their memorandums and protect their rights during negotiations.

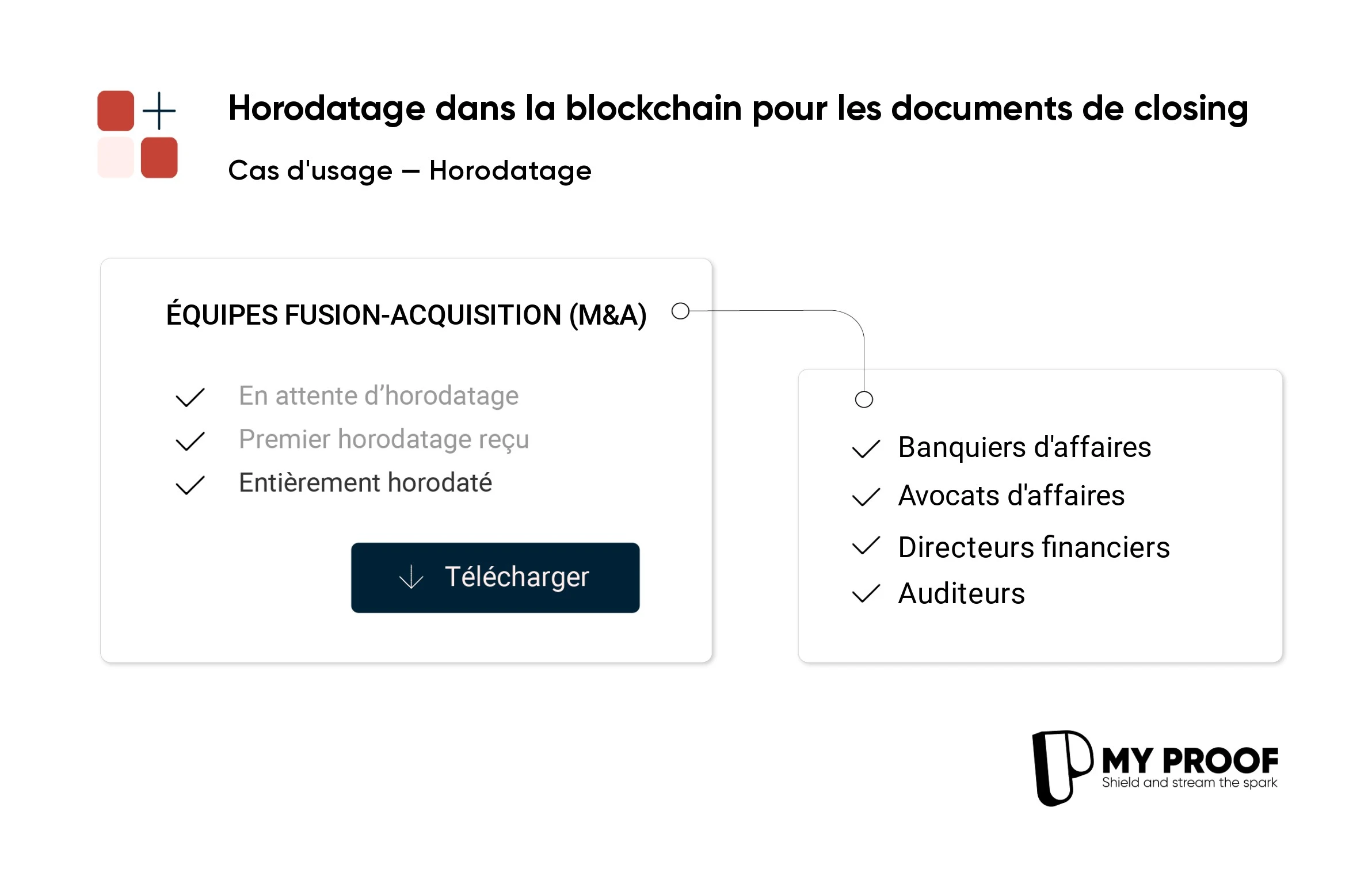

Blockchain time stamping for M&A offers

Visit Mergers & Acquisitions (M&A) teams face challenges in terms of chronology and documentary evidence. Our platform meets these needs with :

- Securing strategic documents

- Traceability of offer versions

- Temporal integrity of negotiations

M&A professionals use MyProof to record transaction milestones. L'blockchain time-stamping for M&A offers creates a reliable history of exchanges. This method ensures the exact chronology of proposals and counter-proposals during the due diligence process.

Secure file sharing for acquisition target analysis

Visit M&A teams face unique challenges when evaluating acquisition targets. MyProof meets these requirements by offering a secure file-sharing platform. This solution facilitates :

- Transferring confidential documents

- Coordination between stakeholders

- Managing access rights to critical information

This secure dataroom enables professionals to carry out their due diligences in the best possible way, while guaranteeing the protection of the data analyzed. Users benefit from a reliable digital environment for their M&A operations.

Secure datarooms for M&A due diligence

Visit M&A professionals require solutions to secure their data during transactions. Our virtual datarooms platform facilitates document sharing and improves the efficiency of M&A processes.

MyProof offers a digital environment dedicated to M&A due diligence. This solution enables :

- Structured information organization

- Controlled distribution of documents

- Managing access to sensitive data

The parties involved in financial and legal due diligence operations can thus collaborate within a secure framework, preserving the confidentiality of exchanges.

No other use cases for the moment.