Use cases

Other use cases for MyProof in financial audit firms

Financial audit firms have to manage confidential financial information while ensuring data integrity and traceability. Our financial audit solution meets requirements for confidentiality, regulatory compliance and secure collaboration with customers and teams.

Secure storage of evidence of financial fraud

Visit financial audit firms frequently manage sensitive data linked to accounting irregularities. Our platform offers a solution for managing and preserving evidence in the event of financial malpractice.

Here are the main features:

- Organization of digital fraud files

- Document access rights management

- Preserving the authenticity of evidence

This solution for securely storing evidence of financial fraud enables auditors to gather and protect evidence in a secure digital space. This facilitates the examination of evidence and its use in legal proceedings.

French cloud for backing up accounting documents

Visit financial audit firms require reliable solutions to protect their data. MyProof, a French cloud for backing up accounting documents, meets this safety requirement.

Our platform, hosted in France, ensures the protection of financial information and complies with current regulations. MyProof users have a secure space in which to store their accounting files, guaranteeing :

- Data confidentiality

- Information integrity

- Document accessibility

This solution enables professionals to manage their digital archives with complete peace of mind, while complying with security and compliance standards.

Secure drive for protecting audit reports

Financial audit firms handle sensitive data on a daily basis. To guarantee the protection of this information, MyProof offers a digital storage solution comprising :

- Encrypted storage space for accounting documents

- An automatic backup mechanism

- An access rights management system

This document management platform meets auditors' needs for secure financial data. Users benefit from secure drive to host their reports and confidential information, ensuring the integrity and confidentiality of audits.

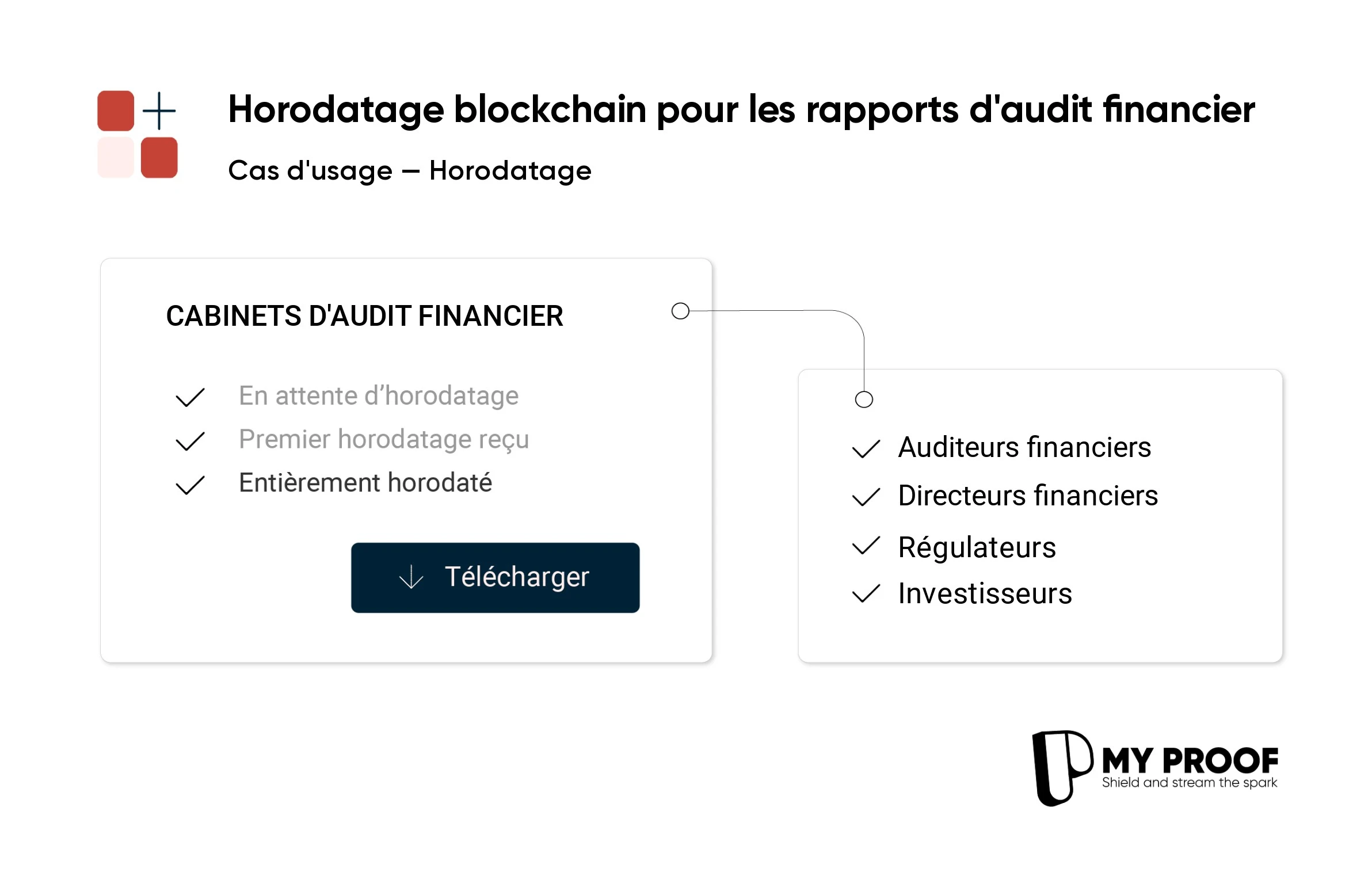

Blockchain time-stamping for financial statements

To verify the authenticity of accounting documents, the financial audit firms are turning to blockchain time-stamping. This technology records the digital footprint of reports on a distributed register, offering traceability of financial statements.

Blockchain time stamping certifies the existence of a document at a given moment and guarantees its integrity. It provides proof of the chronology of changes made to reports. Auditors can thus review historical financial records and identify any unauthorized modifications, reinforcing the reliability of the audit process.

Alternative to the solar envelope for accounting documents

To guarantee the integrity of financial documents, the certified accountants are looking for alternatives to the Soleau envelope. Blockchain technology offers a digital solution for certifying accounting documents.

MyProof uses theblockchain time-stamping to replace traditional methods of preserving evidence. This system enables financial professionals to :

- Certify the existence of a document on a specific date

- Check file integrity over time

- Securing sensitive financial data

This digital approach meets audit firms' needs for traceability and protection of accounting information, while adapting to the demands of the digital world.

Secure file sharing for financial reporting

Visit financial audit firms regularly manage sensitive accounting data on behalf of their customers. MyProof offers a solution for improving collaboration and maintaining confidentiality during the creation of financial reports.

Our platform provides a digital infrastructure for the exchange and storage of accounting documents. It simplifies the preparation of balance sheets and financial statements, while protecting information from unauthorized access. Users benefit from secure dataroom for sharing sensitive filesThis makes it easier to work together on financial issues.

datarooms software for collaboration between audit teams

Visit financial audit firms optimize their processes with the right digital solutions. The benefits of datarooms software for collaboration between audit teams :

- File storage in a protected environment

- Simplified communication between stakeholders

- Authorization control for confidential data

MyProof integrates these functionalities and tracks changes made to documents. This platform enables professionals to carry out their audits in compliance with financial information protection requirements.

Secure datarooms for storing financial audit reports

Visit financial audit firms need reliable solutions to manage their confidential data. Our platform meets this need by offering :

- Secure archiving of audit reports

- Controlled sharing of financial information

- Preserve the integrity of accounting documents

Visit secure dataroom from MyProof centralizes files in a protected virtual environment. This solution facilitates collaboration between teams, while ensuring strict control of access to sensitive information. Users can thus carry out their audit missions in full compliance with security and confidentiality standards.

No other use cases for the moment.