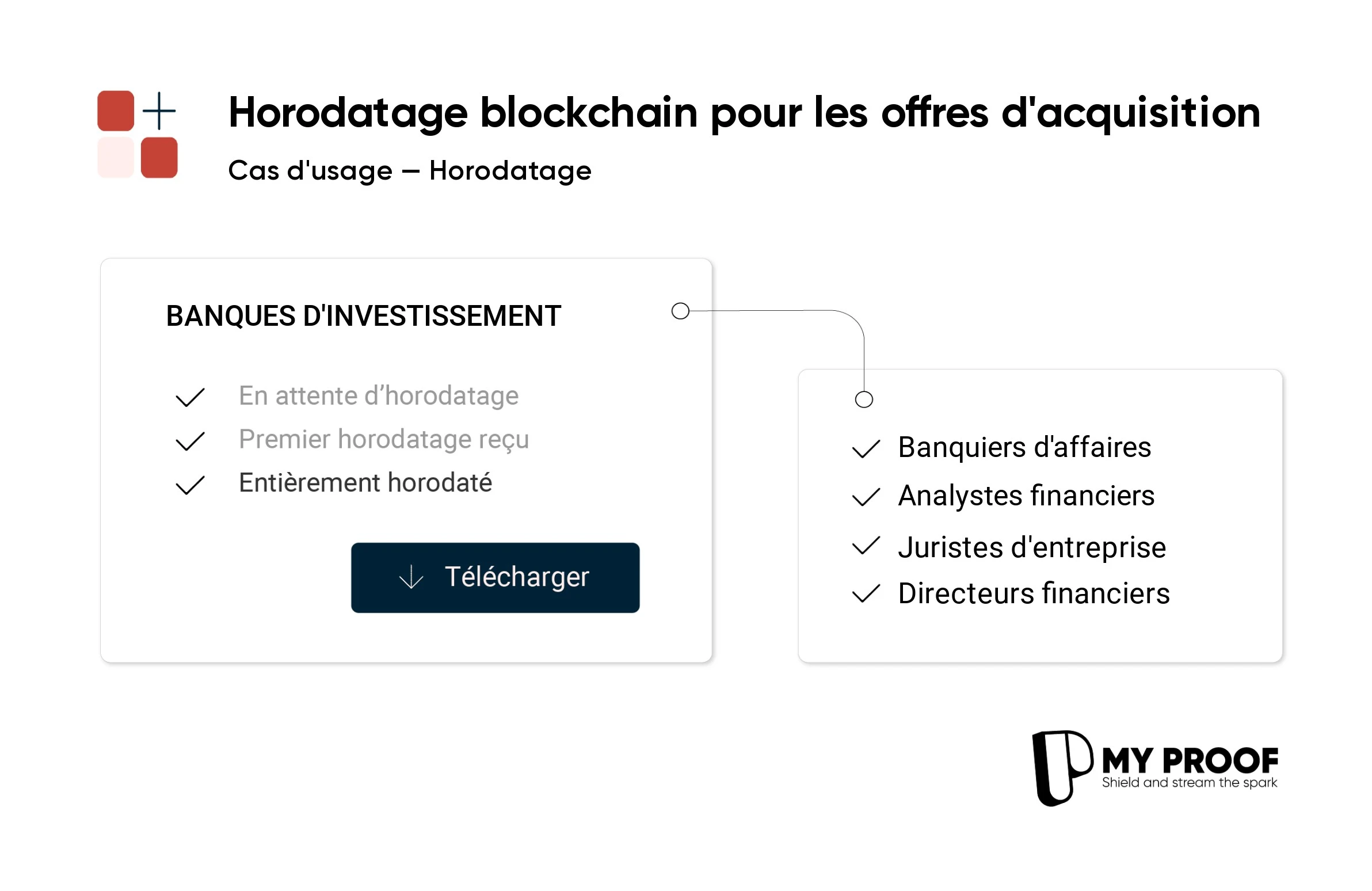

Use cases

Other MyProof use cases at investment banks

Investment banks manage large volumes of confidential financial information and sensitive transactions. You are a investment funds ? We offer you a secure environment for storing, time-stamping and sharing this critical information, while ensuring regulatory compliance.

Secure storage of sensitive transaction data

Financial institutions constantly deal with confidential information linked to money flows. Our system offers a method for preserving the integrity of sensitive data in the banking sector:

- Robust document encryption

- Rigorous access controls

- Compliance with regulatory standards

This approach enables investment banks secure critical information over the long term. Our platform ensures the protection of transaction details and financial records, while making it easier to manage the risks associated with storing confidential information.

Secure drive for storing financial analyses

Visit investment banks The security of their financial documents is of paramount importance. Our platform offers a digital storage solution for your reports and analyses.

Thanks to our secure drive for storing financial analysesyou benefit from :

- Enhanced protection for sensitive data

- Access control for your team

- Centralization of confidential information

This platform enables you to manage your financial documents in a secure environment, safe from unauthorized intrusion.

Partage de fichier sécurisé pour les négociations de transactions financières

Les opérations de fusions-acquisitions et les levées de capital nécessitent un système fiable pour l’échange de documents financiers. Notre plateforme offre une solution adaptée avec un partage de fichiers sécurisé pour les négociations de transactions financières. Ce service permet aux institutions financières de créer un environnement virtuel protégé pour leurs activités.

L’utilisation d’une dataroom électronique facilite l’échange d’informations confidentielles entre les parties impliquées. Notre technologie assure la protection et la confidentialité des données pendant toutes les étapes du processus de due diligence, du début des négociations jusqu’à la finalisation de l’accord. Les investment banks peuvent ainsi mener leurs opérations dans un cadre numérique sécurisé.

Logiciel datarooms pour l'analyse des opportunités d'investissement

Les professionnels de la finance cherchent constamment des projets d’investissement prometteurs. MyProof offre une plateforme pour regrouper les données financières lors de l’évaluation de ces opportunités. Cette solution permet aux équipes d’examiner et d’échanger des informations sensibles de manière sécurisée.

Les analystes financiers peuvent effectuer leurs vérifications préalables et études de marché en utilisant une dataroom conçue pour répondre aux exigences du secteur. Cette approche facilite la prise de décision éclairée pour les investment banks et leurs clients, tout en assurant la confidentialité des données.

Datarooms sécurisées pour les processus de fusions-acquisitions

Les processus de fusions-acquisitions impliquent l’échange de documents confidentiels entre les parties. Pour faciliter ces transactions, les investment banks utilisent des solutions numériques adaptées. Notre dataroom sécurisée pour les processus de fusions-acquisitions offers several advantages:

- Stockage centralisé des informations financières

- Gestion des droits d’accès aux données sensibles

- Optimisation des procédures de due diligence

Cette plateforme permet aux acteurs impliqués dans l’opération d’échanger des fichiers de manière sécurisée, contribuant ainsi à l’efficacité du processus de fusion-acquisition.

No other use cases for the moment.