Use cases

Other MyProof use cases at investment banks

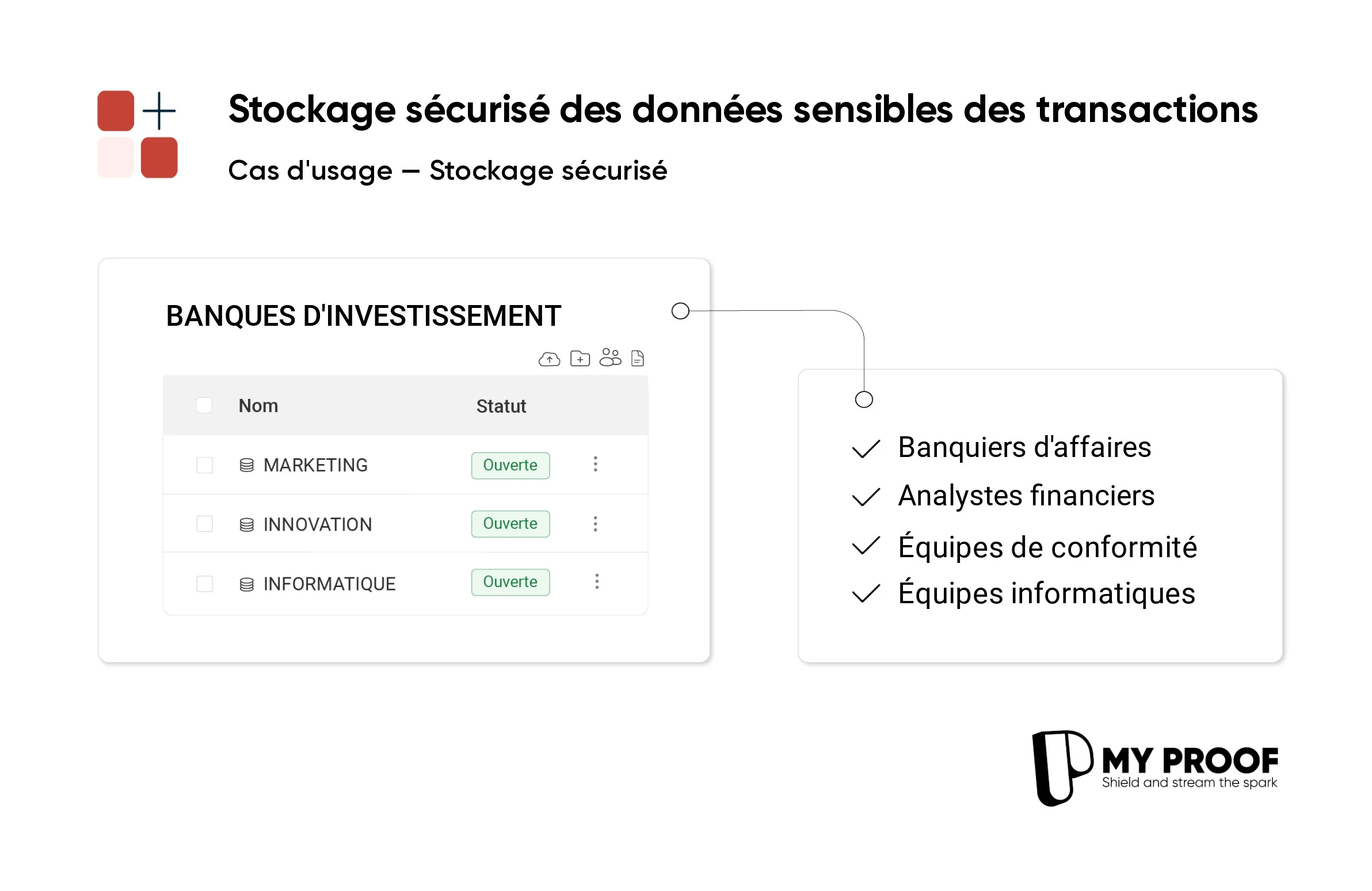

Investment banks manage large volumes of confidential financial information and sensitive transactions. You are a investment funds ? We offer you a secure environment for storing, time-stamping and sharing this critical information, while ensuring regulatory compliance.

French cloud for archiving due diligence reports

Our French hosting infrastructure enables financial institutions to store their due diligence reports in complete safety. MyProof offers a cloud solution that :

- Protects confidential documents

- Easy access to information

- Meets compliance standards

This digital archiving platform, designed in France, meets the needs of investment banks in document management and preservation of information assets.

Secure drive for storing financial analyses

Visit investment banks The security of their financial documents is of paramount importance. Our platform offers a digital storage solution for your reports and analyses.

Thanks to our secure drive for storing financial analysesyou benefit from :

- Enhanced protection for sensitive data

- Access control for your team

- Centralization of confidential information

This platform enables you to manage your financial documents in a secure environment, safe from unauthorized intrusion.

Blockchain time stamping for financial contracts

Visit investment banks and other financial institutions process numerous contracts and transactions every day. To guarantee the integrity of these documents, the’blockchain time-stamping of financial contracts is an effective solution.

- Certification of the existence of a document at a specific point in time

- Proof of non-modification of contracts

- Strengthening trust between parties

This system enables financial institutions to comply with transaction traceability standards, while ensuring the authenticity of their contractual agreements.

Blockchain time-stamping for takeover bids

Mergers and acquisitions (M&A) transactions require optimum security for investment banks. The use of blockchain technology for time-stamping documents offers a reliable solution. This process guarantees the authenticity and precise date of files linked to financial transactions.

Our system integrates thisblockchain time-stamping for takeover bidsThis method enables banking institutions to improve the traceability of their processes. By applying this method to purchase proposals, financial institutions create an unalterable history, reinforcing the confidence of the players involved in these strategic transactions.

Secure file sharing for financial transaction negotiations

M&A transactions and capital raisings require a reliable system for exchanging financial documents. Our platform offers an adapted solution with a secure file sharing for financial transaction negotiations. This service enables financial institutions to create a protected virtual environment for their activities.

The use of an electronic dataroom facilitates the exchange of confidential information between the parties involved. Our technology ensures data protection and confidentiality at every stage of the due diligence process, from the start of negotiations to the finalization of the deal. Visit investment banks can carry out their operations in a secure digital environment.

datarooms software for analyzing investment opportunities

Financial professionals are constantly on the lookout for promising investment projects. MyProof offers a platform for consolidating financial data when evaluating these opportunities. This solution enables teams to review and exchange sensitive information securely.

Financial analysts can carry out their due diligence and market research using a dataroom designed to meet industry requirements. This approach facilitates informed decision-making for investment banks and their customers, while ensuring data confidentiality.

Secure datarooms for M&A processes

M&A processes involve the exchange of confidential documents between parties. To facilitate these transactions investment banks use appropriate digital solutions. Our secure dataroom for M&A processes offers several advantages:

- Centralized storage of financial information

- Manage access rights to sensitive data

- Optimizing due diligence procedures

This platform enables the players involved in the deal to exchange files securely, contributing to the efficiency of the M&A process.

No other use cases for the moment.