Use cases

Other uses for MyProof among venture capital funds

Venture capital funds manage confidential information on startups and innovative companies. Our data security software for venture capital funds enables this sensitive information to be stored, shared and time-stamped, while facilitating collaboration between investment teams and stakeholders.

Secure storage of startup pitches and business plans

MyProof offers a document management solution for venture capital funds which handle a constant flow of pitches and business plans. This platform enables you to :

- Organizing startup files

- Manage access rights

- Protecting confidential information

Thanks to this system, investors can analyze projects while maintaining the integrity of the evaluation process. The secure storage guarantees the protection of sensitive data held by entrepreneurs and venture capitalists.

French cloud for market analysis

Venture capitalists use market research to guide their investment decisions. MyProof offers a hosting solution on a French cloud that centralizes this data:

- Storage of analysis reports

- Information access management

- Collaboration between teams

This platform enables investors to store their strategic documents in a secure storage. This gives teams access to the information they need to assess investment opportunities, while preserving the confidentiality of the data they collect. venture capital funds and their activities.

Secure drive for storing investment files

Venture capitalists manage sensitive information linked to their investment portfolios. MyProof offers a digital storage solution to meet their security requirements. Our platform makes it possible to organize and store investment files in a structured way in a secure drive.

This system guarantees the protection and confidentiality of financial data. Visit venture capital funds can thus :

- Collaborate on their investment projects

- Share due diligence documents

- Secure their strategic information

The MyProof platform provides a secure environment for managing digital assets linked to investment operations.

Blockchain time-stamping for term sheets

Visit term sheets play a key role in venture capital funds. Our technology uses blockchain time-stamping for these documents, reinforcing their integrity and traceability.

Recording term sheets in the blockchain creates an immutable digital footprint. This process makes it possible to :

- Establish proof of existence at time T

- Verify version authenticity

- Prevent unauthorized modifications

In this way, investors can trace the history of documents and avoid conflicts arising from changes in initial conditions.

Alternative to the soleau envelope for business plans

To protect their investment projects, venture capitalists are looking for alternatives to the Soleau envelope. MyProof meets this need with a digital platform based on blockchain technology. This solution makes it possible to establish proof of anteriority for documents linked to fundraising and startups.

L'blockchain time-stamping offers several advantages for venture capital funds :

- Recording the digital footprint of business plans

- Guaranteeing document integrity

- Certification of creation date

This method enables investors and entrepreneurs to reliably secure their innovative ideas, an essential aspect in the startup and venture capital ecosystem.

Blockchain time-stamping for startup pitches

Venture capitalists regularly evaluate new entrepreneurial projects. Our technology provides a solution for securing presentations of these innovative initiatives.

L'blockchain time-stamping for startup pitches certifies the origin and date of the concepts presented. This process protects intellectual property during presentation sessions to the public. venture capital funds.

This system creates a secure environment for exchanges between project promoters and investors. It enhances transparency in the startup evaluation and financing process.

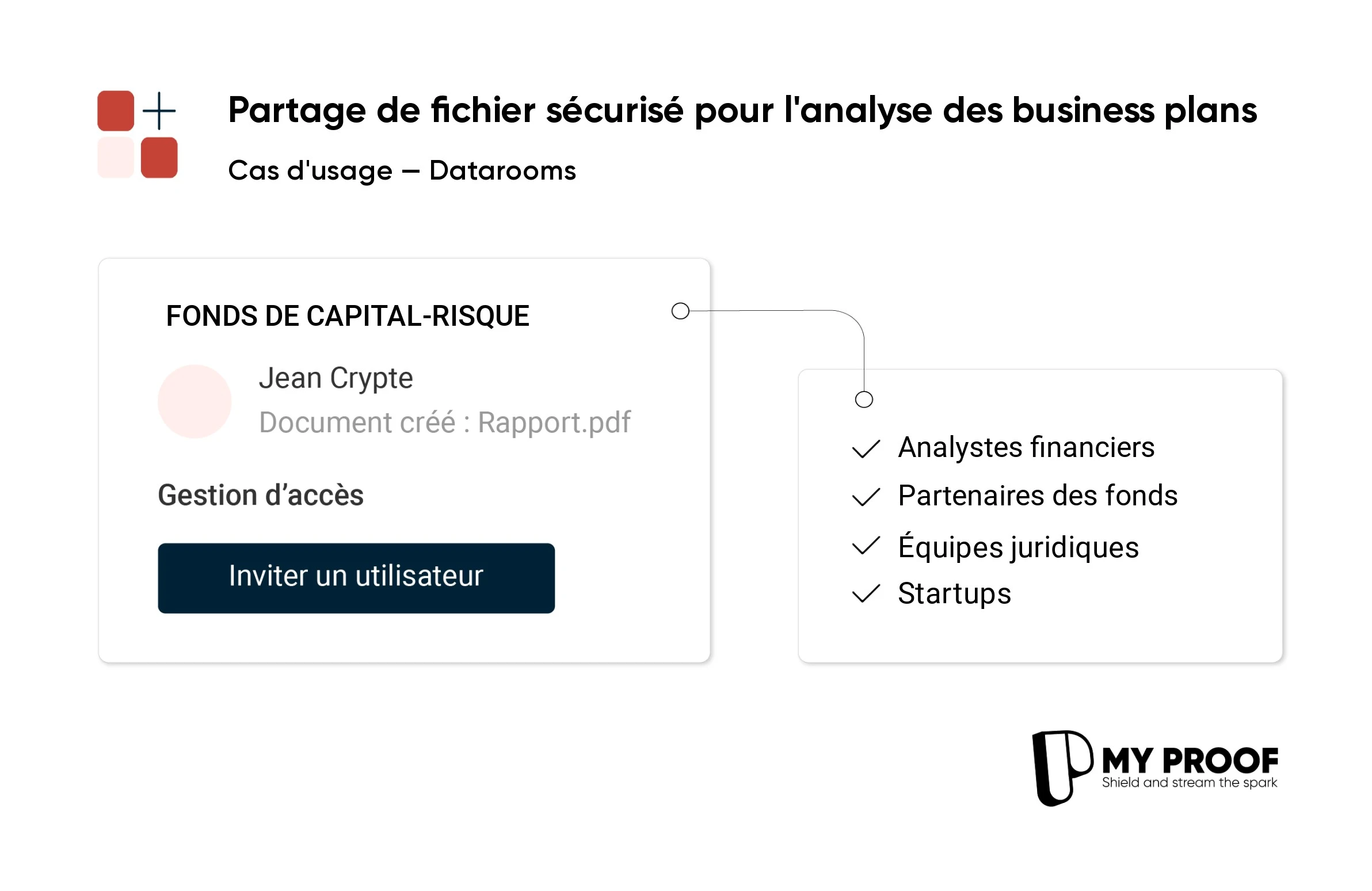

Datarooms software for VC evaluation of startups

Startup valuation is a core business for venture capitalists. MyProof offers a centralized solution for collecting and analyzing financial data from companies seeking financing. This dataroom enables investors to carry out their due diligence efficiently, while preserving the confidentiality of information shared by startups.

- Centralization of financial documents

- Secure information exchange

- Optimizing the assessment process

Thanks to this platform venture capital funds can methodically examine investment opportunities in the innovative start-up ecosystem.

Secure datarooms for investment committee presentations

Presentations to investment committees are frequent for venture capital funds. MyProof facilitates this process with an investment file management solution.

Our secure dataroom offer :

- Structuring financial data

- Controlled distribution to investors

- Access rights management

Investment teams can collaborate on their projects while protecting confidential information. This secure platform optimizes due diligence and fundraising workflows.

No other use cases for the moment.