Use cases

Other uses for MyProof among venture capital funds

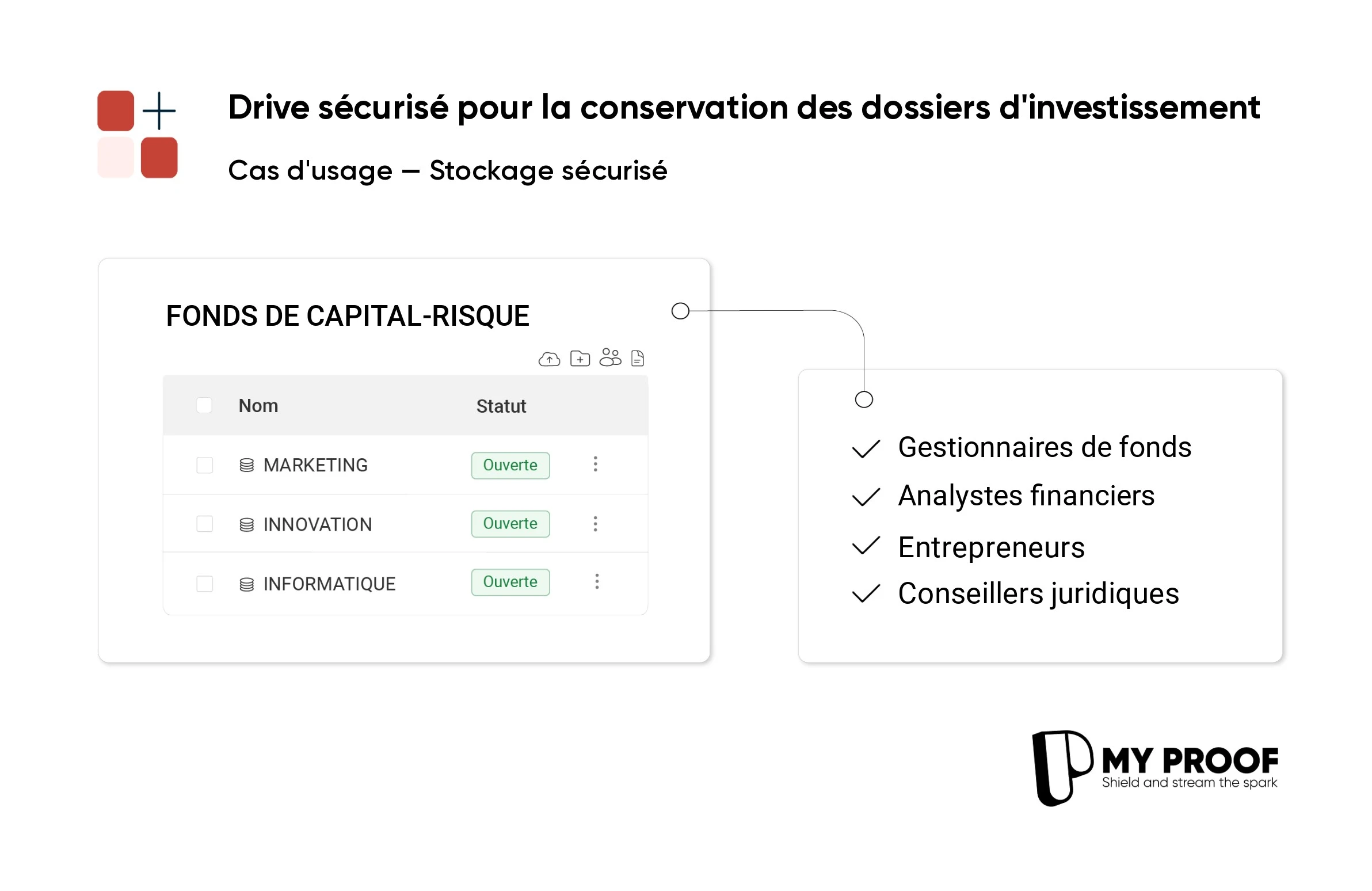

Venture capital funds manage confidential information on startups and innovative companies. Our data security software for venture capital funds enables this sensitive information to be stored, shared and time-stamped, while facilitating collaboration between investment teams and stakeholders.

Secure storage of startup pitches and business plans

MyProof offers a document management solution for venture capital funds which handle a constant flow of pitches and business plans. This platform enables you to :

- Organizing startup files

- Manage access rights

- Protecting confidential information

Thanks to this system, investors can analyze projects while maintaining the integrity of the evaluation process. The secure storage guarantees the protection of sensitive data held by entrepreneurs and venture capitalists.

Blockchain time-stamping for term sheets

Visit term sheets play a key role in venture capital funds. Our technology uses blockchain time-stamping for these documents, reinforcing their integrity and traceability.

Recording term sheets in the blockchain creates an immutable digital footprint. This process makes it possible to :

- Establish proof of existence at time T

- Verify version authenticity

- Prevent unauthorized modifications

In this way, investors can trace the history of documents and avoid conflicts arising from changes in initial conditions.

Alternative to the soleau envelope for business plans

To protect their investment projects, venture capitalists are looking for alternatives to the Soleau envelope. MyProof meets this need with a digital platform based on blockchain technology. This solution makes it possible to establish proof of anteriority for documents linked to fundraising and startups.

L'blockchain time-stamping offers several advantages for venture capital funds :

- Recording the digital footprint of business plans

- Guaranteeing document integrity

- Certification of creation date

This method enables investors and entrepreneurs to reliably secure their innovative ideas, an essential aspect in the startup and venture capital ecosystem.

Blockchain time-stamping for startup pitches

Venture capitalists regularly evaluate new entrepreneurial projects. Our technology provides a solution for securing presentations of these innovative initiatives.

L'blockchain time-stamping for startup pitches certifies the origin and date of the concepts presented. This process protects intellectual property during presentation sessions to the public. venture capital funds.

This system creates a secure environment for exchanges between project promoters and investors. It enhances transparency in the startup evaluation and financing process.

Partage de fichier sécurisé pour l'analyse des business plans

MyProof offre une plateforme de partage de fichiers sécurisé conçue pour les besoins des venture capital funds. Cette solution permet aux investisseurs d’évaluer efficacement les opportunités d’affaires en :

- Regroupant les plans d’entreprise des startups

- Facilitant l’examen des états financiers

- Assurant la sécurité des données confidentielles

Grâce à cette dataroom numérique, les équipes d’investissement peuvent étudier les projets potentiels dans un environnement qui garantit la protection des informations stratégiques.

Logiciel datarooms pour l'évaluation de startups par les VC

L’évaluation de startups constitue une activité principale pour les sociétés de capital-risque. MyProof offre une solution centralisée pour la collecte et l’analyse des données financières des entreprises en quête de financement. Cette dataroom permet aux investisseurs d’effectuer leur due diligence de manière efficace, tout en préservant la confidentialité des informations partagées par les startups.

- Centralization of financial documents

- Sécurisation des échanges d’informations

- Optimisation du processus d’évaluation

Grâce à cette plateforme, les venture capital funds peuvent examiner de façon méthodique les opportunités d’investissement dans l’écosystème des jeunes entreprises innovantes.

No other use cases for the moment.