Use cases

Other MyProof use cases in the finance and investment sector

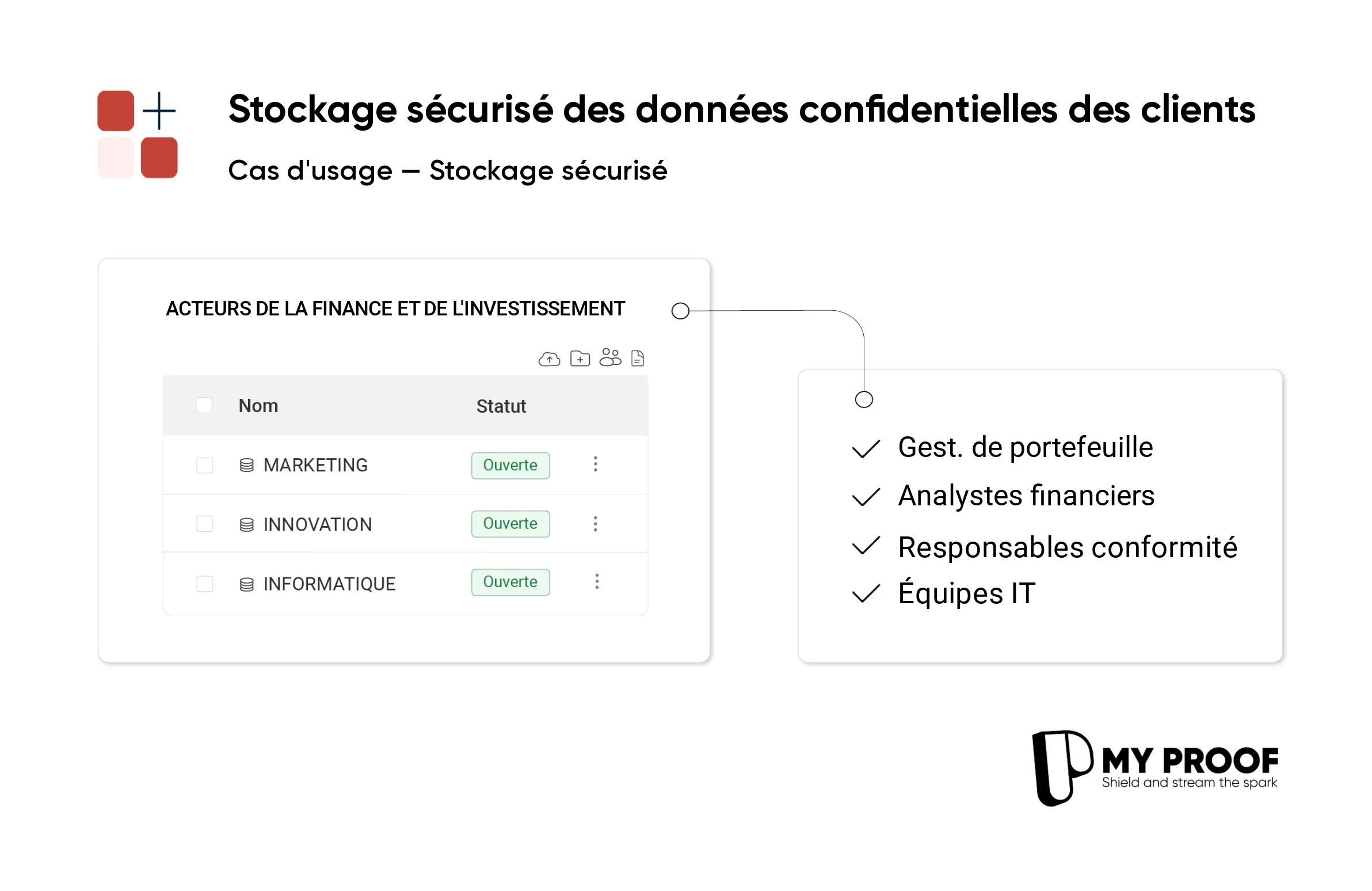

Finance and investment professionals have to manage confidential financial information while complying with strict regulations. Our secure financial data management solution meets industry compliance and security requirements, while facilitating the exchange of sensitive information with customers and partners.

French cloud for archiving investment reports

Financial sector professionals need secure systems to store their documents. The MyProof platform offers a solution forarchiving of investment reports on a cloud infrastructure based in France.

Main features :

- Compliance with French regulations

- Securing sensitive data

- Accessible document management system

This approach enables financial players centralize their financial analyses while respecting banking industry standards. Fund managers can store and access their reports in a secure French cloud environment.

Blockchain time-stamping for due diligence documents

The MyProof platform integrates blockchain technology for thetime-stamping of due diligence documents. This system enhances the security of financial valuation processes by ensuring the authenticity and integrity of the files used.

Visit finance and investment professionals benefit from a precise certification tool for the date and content of each document. Blockchain time-stamping offers complete traceability, enabling financial information to be verified throughout audits. This technology guarantees the reliability of data examined during business valuations and transactions, providing an immutable record of documents used in the due diligence process.

Alternative to the soleau envelope for investment reports

In finance and investment, dating documents is essential. Blockchain technology offers a modern solution for this task. MyProof offers a digital method to replace the Soleau envelope thanks to this innovation.

This system ensures the traceability and authenticity of financial reports. Visit finance and investment players can protect their confidential information with a tool tailored to their needs. Blockchain guarantees the immutability of data, offering protection against tampering. This method ofblockchain time-stamping meets the security requirements of the financial sector, while simplifying verification and auditing processes.

Blockchain time stamping to secure financial transactions

The integrity of financial operations is a priority for institutions in the sector. Ourblockchain time-stamping meets this need by providing :

- An immutable distributed register

- Complete traceability of transactions

- Strengthening trust between parties

MyProof customers benefit from a proof system for their financial documents. This feature facilitates audits and resolves disputes by proving the existence of financial documents. financial transactions at an instant T. Time-stamping on the blockchain thus contributes to regulatory compliance and the transparency of monetary exchanges.

Secure file sharing for analysis of investment opportunities

In the financial sector, analyzing investment opportunities involves sharing confidential documents. To meet this need, MyProof offers a solution for dataroom platform. This platform provides a secure environment for conducting due diligence and evaluating investment files.

Financial professionals use this digital space to exchange sensitive information in complete confidence. Visit secure sharing platform for analyzing investment files MyProof enables finance and investment players collaborate effectively. Teams can review financial data and assess opportunities in a protected environment, ensuring confidentiality of critical information throughout the process.

Datarooms software for fundraising

MyProof offers a document management solution designed for fund-raising. Our platform facilitates exchanges between entrepreneurs and investors during financing rounds:

- Centralization of financial documents

- Performing due diligence

- Securing confidential information

This dataroom for fundraising streamlines the financing process by guaranteeing the confidentiality of data shared between stakeholders.

Secure datarooms for financial due diligence

Protecting sensitive information is essential for financial reviews. Our platform meets industry requirements for data security. This virtual data room optimizes due diligence processes while guaranteeing the confidentiality of balance sheets and financial statements.

The secure interface enables teams to carry out their assessments in a controlled environment. Visit financial analysts have a collaborative space to share documents with authorized parties. The platform offers restricted access to information required for accounting audits and financial risk analysis.

No other use cases for the moment.